GlobalLinkagesLab

We invite applications for a one-year, full-time Pre-Doctoral Research Associate position in international economics, finance, and trade. Directed by Prof. Şebnem Kalemli-Özcan, the Lab offers a uniquely focused, data-intensive environment that goes beyond comparable programs. Pre-docs work directly with several faculty on frontier projects—global production, trade and finance networks, dollar dominance, policy spillovers, capital misallocation, geopolitics and international economic linkages, and green-transition finance—using state-of-the-art micro-linked global datasets housed in our dedicated Data Center.

We invite applications for a one-year, full-time Pre-Doctoral Research Associate position in international economics, finance, and trade. Directed by Prof. Şebnem Kalemli-Özcan, the Lab offers a uniquely focused, data-intensive environment that goes beyond comparable programs. Pre-docs work directly with several faculty on frontier projects—global production, trade and finance networks, dollar dominance, policy spillovers, capital misallocation, geopolitics and international economic linkages, and green-transition finance—using state-of-the-art micro-linked global datasets housed in our dedicated Data Center.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

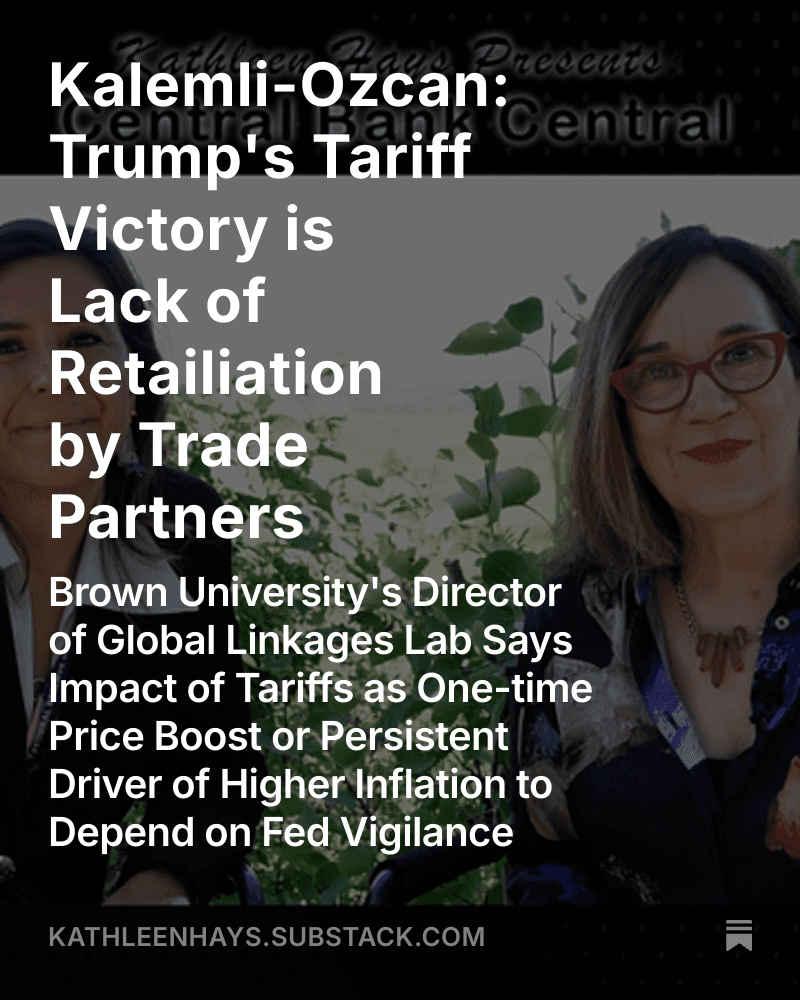

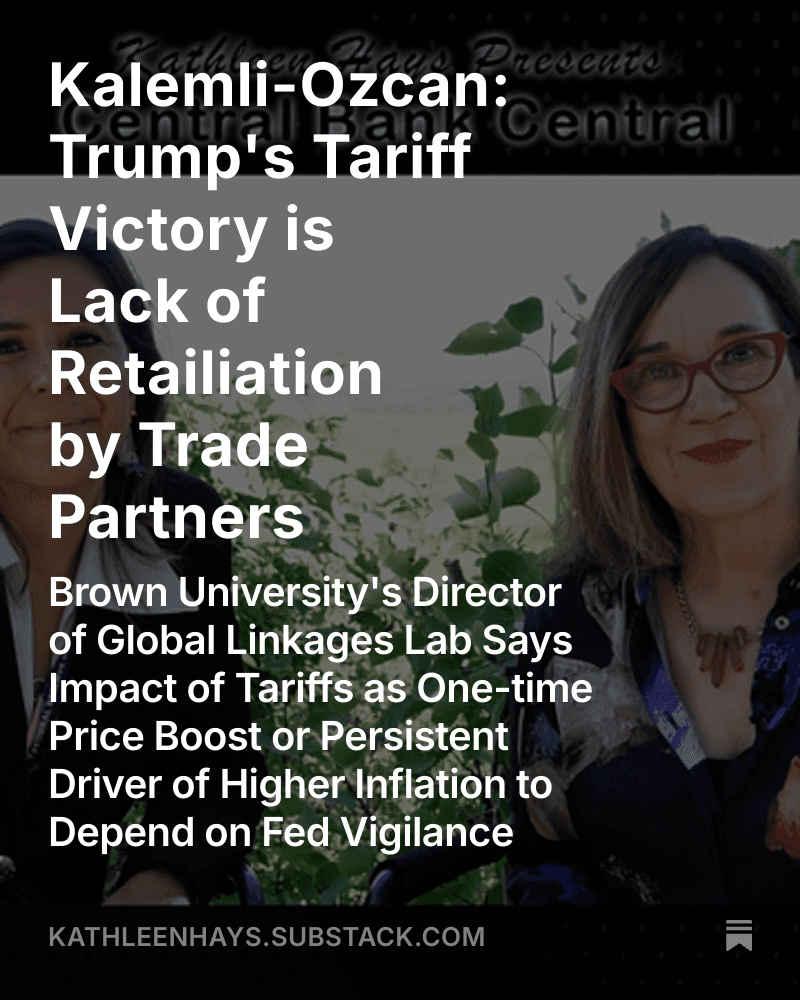

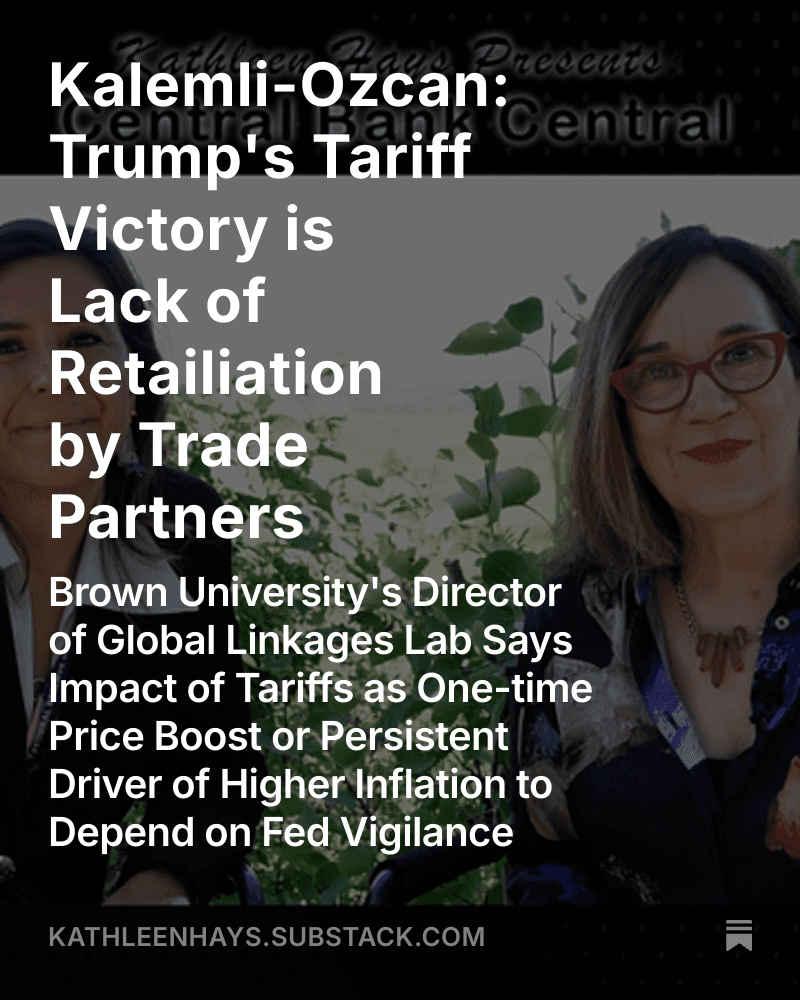

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Our Director Prof. Kalemli-Özcan gave an interview to Guardian on GLL tariff project that shows the potential stagflationary impact of tariffs on the US economy and on other countries. She argues that it is important to have theory that meets data since if stagflation rolls out at a slow pace, because firms are waiting to pass through the cost of tariffs, then data will not pick it up right away. GLL's work explains how firms can decide to pass through their higher tariff-induced costs on to consumers, leading to inflation later, where unemployment can be observed before.

Our Director Prof. Kalemli-Özcan joins Anne Krueger, Mohamed El-Erian, and Gabriel Chodorow-Reich on the importance of FED independence for domestic and global macro and financial stability.

Our Director Prof. Kalemli-Özcan joins several social scientists for 2026 predictions of the Project Syndicate. She argues that, in the year ahead and beyond, globalization is set to become more fragmented, more complex, and more unequal. Supply chains will grow longer and riskier, while the technological arms race between the US and China could destabilize the global economic system. Paradoxically, dollar dominance may coexist with a weakening dollar. This shift is unfolding in an increasingly zero-sum geopolitical environment shaped by global and regional rivalries. Social welfare is set to decline worldwide, even as an AI-driven productivity surge benefits a narrow set of firms, sectors, and countries. Multilateral institutions will be more necessary than ever, but politics and policymaking will continue to drift away from cooperative economic frameworks.

Our Director Prof. Kalemli-Özcan's interview with Newsweek on how to think the macroeconomy in a disaggregated manner not only as poor and rich households but also small and large firms and related risks from such K-Shaped economy.

Our Director Prof. Kalemli-Özcan's PS column this month argues that financial market complacency in the face of U.S. policy uncertainty is a profitable strategy.

Our Director Prof. Kalemli-Özcan's interview at the 2025 Jackson Hole Conference focuses on the impact of tariffs on inflation. GLL's research shows that whether there is a one-time price jump versus persistent inflation depends on FED's response. She also mentions the importance of lack of retaliation.

Our Director Prof. Kalemli-Özcan's recent interview with Bloomberg during the Jackson Hole meetings (the link below from the 25th minute onwards) explains why tariffs constitute a stagflationary shock for the US, if they end up staying on for many countries and sectors in excess of 10 percent. The interview is based on the work done by GLL members Şebnem Kalemli-Özcan, Can Soylu and Muhammed Yildirim.

Our Director Prof. Kalemli-Özcan's this month's PS column explains how populist leaders' push for low interest rates meant to cloak the destructive impact of their misguided economic policies such as tariffs.

Our Director Prof. Kalemli-Özcan is featured in the 'SheWrites' newsletter of Project Syndicate.

Our Director Prof. Kalemli-Özcan's Bloomberg TV interview highlights the damaging impact of large tariffs on the U.S. economy even before the ''Liberation Day'' tariffs unveiled on April 2nd. Her key point centers on the supply shock created by large tariffs and uncertainty surrounding the trade policy.

On her April 1st interview with Time Magazine, GLL Director Prof. Kalemli-Özcan argued that the Liberation Day tariffs, if end up being large, can start a global trade war, hurting American consumers and businesses at the end the most.

How do different risk premia for currency, policy and country interact? Which one matters for investors? These are key questions given increased US policy uncertainty. Our Director Prof. Kalemli-Özcan explains in an FT op-ed.

Our Director Prof. Kalemli-Özcan and several other economists shared their views on the potential impact of tariffs on the US economy recession risk in a recent Newsweek interview.

The whiplash from the Donald Trump administration's on-again, off-again tariff policy is leading to a lot of uncertainty, argues our Director Prof. Kalemli-Özcan, affecting both wall street and main street.

In an FT interview, our Director Prof. Kalemli-Özcan argued that U.S. unemployment could rise as businesses make cuts in the face of higher costs borne from tariffs and higher wages resulting from changes in immigration policy.

In an interview with the FT, our Director Prof. Şebnem Kalemli-Özcan explained the potential stagflationary impact of the tariffs proposed by the Trump administration.

In a Q&A, our Director Professor Şebnem Kalemli-Özcan discussed how the new presidential administration's planned tariffs could potentially impact the U.S. economy.

Three of our GLL projects have been cited in the 2025 Economic Report of the President. The papers make the following points: the key drivers of pandemic era inflation is robust demand coinciding with negative supply shocks; global capital flows and global technology ownership is linked; foreign direct investment needs financial markets to be beneficial for growth.

Highlighted Research

All Research

Both tariff and monetary policy uncertainty in the U.S. can impact the dollar. Standard macro-trade models predict that unilateral tariffs appreciate the implementing country’s currency, but we show this result can be overturned by policy uncertainty surrounding the tariffs. Higher tariff uncertainty increases precautionary savings and risk premia, leading to immediate currency depreciation even as tariffs rise. If there were to be more uncertainty surrounding the monetary policy and FED independence, 2026 can witness further weakness of the dollar.

We develop a new framework to study how trade policy and central bank actions interact in a world connected through trade and finance. The model captures how tariffs and other trade barriers affect inflation, employment, output, and the exchange rate—particularly when countries are linked through complex input–output networks. Our findings show that tariffs operate as both supply and demand shocks, generating broad ripple effects across the global economy. The magnitude and direction of these effects depend critically on how central banks respond. Using the model, we replicate key features of the U.S. experience during the 2018 tariff hikes, including slower growth, rising inflation, and a stronger U.S. dollar. We apply our framework to "Liberation Day" tariffs as well. Importantly, we also find that even tariff threats—announcements that are later reversed—can negatively affect the economy.

We developed a global economic model to understand how disruptions in one part of the world—such as low vaccination rates in emerging economies during the COVID-19 pandemic—can affect advanced economies. When developing countries were forced to impose lockdowns due to uncontrolled infections, the global economy experienced ripple effects: shortages of critical inputs, higher import prices, and weaker external demand for exports from advanced economies. Our model quantifies the economic costs of these disruptions for wealthier countries and shows that the magnitude of the impact depends heavily on how interconnected industries are through global supply chains. The key insight is clear: investing in vaccine access for lower-income countries is not just a humanitarian imperative—it is also a sound economic strategy for advanced economies seeking to safeguard their own growth and stability.

Global Linkages Lab

The Global Linkages Lab hosts a diverse range of raw and derived datasets on global trade and financial linkages, at a granular level, enabling to ignite path breaking research on issues such as global networks, tariffs and sanctions, trade and inflation, domestic and global productivity, misallocation of global capital, financing of green transition, dominance of the dollar, the global impact of U.S. fiscal, monetary and trade policies, geopolitics led global fragmentation and disengagement amidst significant global challenges. One of our primary goals is to provide a valuable public service, by sharing our data and hosting seminars and large conferences.